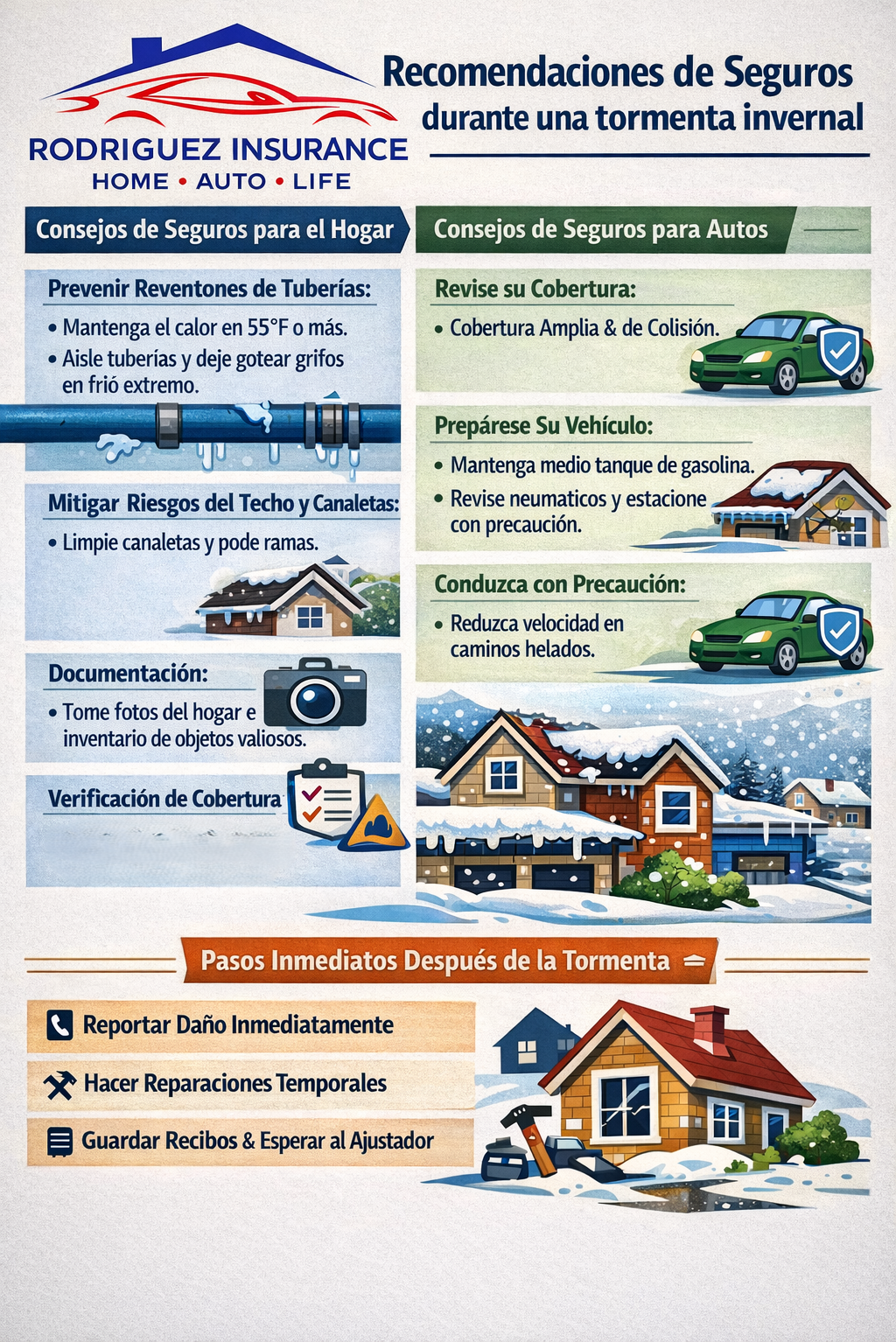

Be ready for the winter storm

Home Insurance Recommendations

Maintaining your home is critical because standard policies often exclude damage caused by negligence or failure to perform regular maintenance.

Prevent Pipe Bursts:

Maintain interior heat at a minimum of 55°F at all times.

Insulate pipes in unheated areas (basements, attics, garages) and seal cracks in exterior walls.

Open cabinet doors under sinks and allow faucets to drip slightly during extreme freezes to keep water moving.

Mitigate Roof and Gutter Risks:

Clear gutters of debris to prevent ice dams, which can cause water to seep under shingles and damage interiors.

Trim dead or overhanging tree branches that could snap under the weight of snow or ice and fall onto your home.

Documentation: Before the storm hits, take photos or videos of your home’s condition and create an inventory of high-value items to support future claims.

Coverage Check: Standard policies typically cover roof collapses from snow weight and burst pipes, but they usually exclude flooding caused by sudden snowmelt.

Auto Insurance Recommendations

Coverage for winter-related vehicle damage depends on having specific "full coverage" options.

Review Your Coverage:

Comprehensive Coverage: Required for non-collision damage, such as a tree falling on your parked car or a roof collapse in your garage.

Collision Coverage: Necessary if your vehicle slides on ice and hits another car or a fixed object like a mailbox.

Prepare Your Vehicle:

Keep your gas tank at least half full (preferably near full) to prevent fuel lines from freezing and to ensure you have heat if stranded.

Check tire pressure and tread; cold temperatures cause pressure to drop, reducing traction.

Safe Parking: If possible, park in a garage or away from large trees and power lines that could fall during the storm.

Claims Prevention: Reduce your speed and avoid sudden movements (braking/steering) on icy roads. Filing multiple claims, even for minor incidents, can lead to premium surcharges at renewal.

Immediate Post-Storm Steps

If you sustain damage, contact your agent immediately. Most insurers provide 24/7 claims reporting. Make temporary repairs (like boarding a broken window) to prevent further damage, but save all receipts and do not sign contracts for permanent repairs until an adjuster has inspected the site.

If you don’t have an Insurance Agent, feel free to contact us